In today’s financial landscape, your credit score is more than just a number; it’s a key that unlocks opportunities, from securing favorable loan rates to renting your dream apartment. Building a strong credit score, however, isn’t a magic trick. It’s a journey of consistent habits and smart financial decisions. While some credit repair agencies may promise overnight miracles, the reality is that lasting improvement takes time and dedication. But don’t be discouraged! With a strategic approach, you can steadily elevate your score and open doors to a brighter financial future, and even earn a little extra along the way.

Understanding Your Starting Point: Credit Reports and Monitoring

The first step is understanding where you stand. Regularly checking your credit reports is crucial. Whether you use Credit Karma or access your reports directly from the major credit bureaus, this practice allows you to monitor your progress and identify any errors or inaccuracies. Even minor discrepancies can negatively impact your score, so don’t hesitate to dispute them. If successful, these disputes can yield positive results within 30 days. Complement this practice by signing up for free credit monitoring. This service acts as an early warning system, alerting you to any significant changes in your credit profile. Promptly addressing any suspicious activity can prevent fraudulent actions from damaging your score.

Tackling Debt: Strategies for Effective Payoff

Next, take a clear-eyed look at your debt. Gather all your bills and create a comprehensive plan to tackle them. Two popular strategies are the snowball and avalanche methods. The snowball method prioritizes paying off the smallest balances first, providing quick wins and boosting motivation. The avalanche method, on the other hand, focuses on paying off debts with the highest interest rates first, minimizing the overall interest paid. Choose the method that aligns with your financial personality and stick to it. If you’re overwhelmed by multiple credit card balances, consider consolidating them into a balance transfer card, simplifying your monthly payments and potentially lowering your interest rates.

Building Positive Habits: Consistency is Key

Consistency is paramount in building a solid credit history. Setting up autopay for your credit card bills ensures you never miss a payment, a crucial factor in maintaining a positive payment history. Consider taking it a step further by paying twice a month, splitting your monthly payment into two bi-weekly installments. This strategy allows you to make extra payments throughout the year, reducing your principal balance faster and saving on interest charges.

Leveraging Opportunities: Negotiation and Diversification

Don’t be afraid to negotiate. Contact your credit card issuers and inquire about lowering your interest rates. A lower rate can significantly accelerate your debt payoff, reducing your credit utilization ratio and boosting your score. Similarly, asking for a credit limit increase can also lower your credit utilization, but be mindful that some issuers perform a hard credit check, which can temporarily impact your score. Diversifying your credit mix, while not a major factor, can demonstrate responsible credit management to lenders. While you shouldn’t take on unnecessary debt, consider incorporating a mix of revolving credit (credit cards) and installment loans (mortgages, auto loans) into your portfolio. If you’re new to credit, becoming an authorized user on someone else’s account can be a valuable starting point, but choose someone with a strong credit history. Credit-builder loans and secured credit cards are also excellent tools for establishing or rebuilding credit.

Avoiding Common Pitfalls: Long-Term Strategies

Remember, building credit is a long-term commitment, not a quick fix. Avoid the pitfalls of applying for multiple credit cards or loans in a short period, as this can raise red flags for lenders. Don’t carry a balance on your credit card just to “build credit,” as this only leads to unnecessary interest charges. And unless you have a compelling reason, avoid closing credit card accounts, as this can negatively impact your credit history length.

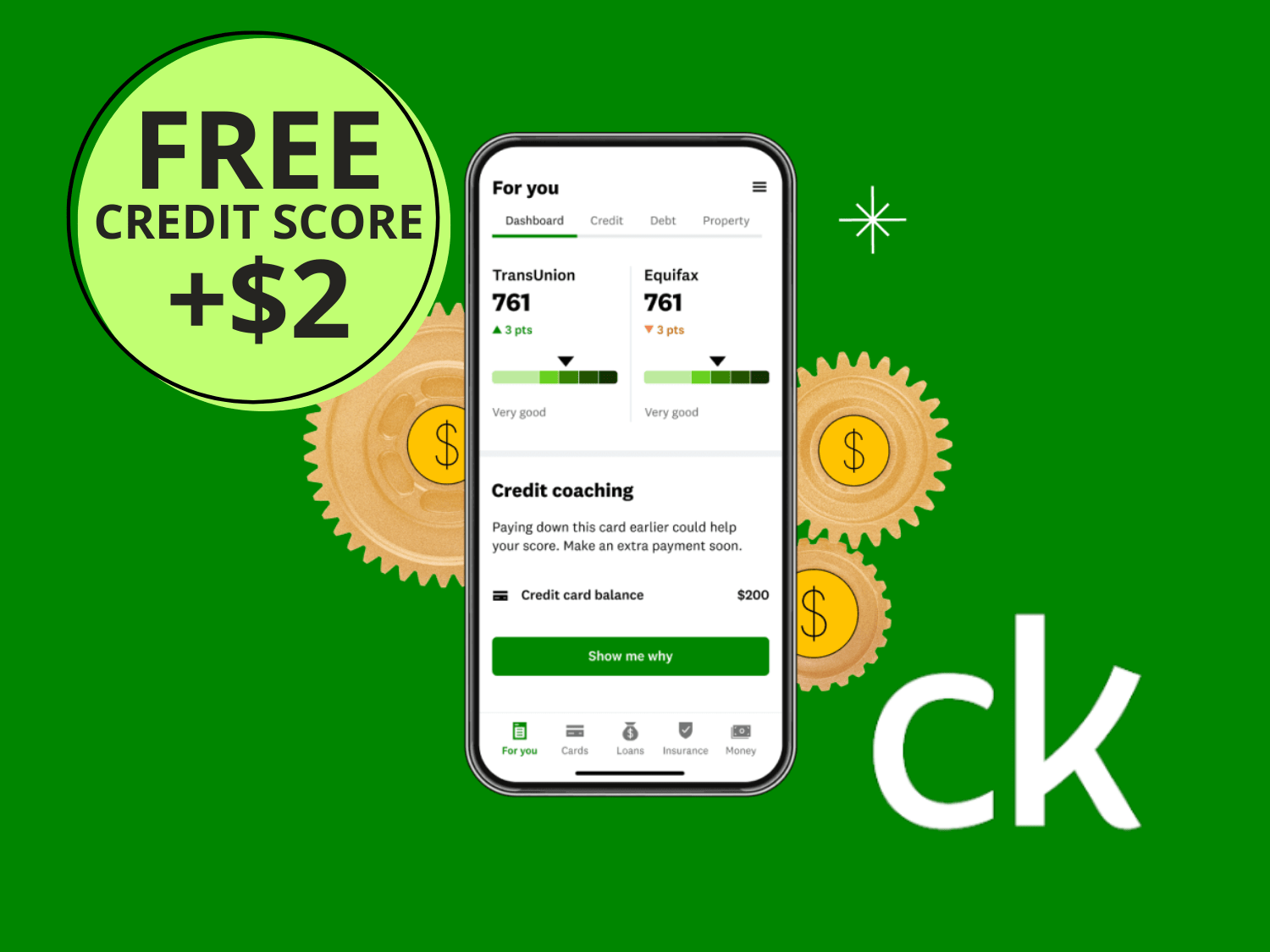

Get Started Today: Free Credit Score and a Cash Bonus!

Ready to take control of your credit journey and earn a quick $2? Credit Karma provides a free credit score and personalized insights to help you understand and improve your credit. Get started today and see where you stand. And here’s a bonus for Android users: The Mode Earn App is giving away $2 in Mode Points to anyone who creates a new Credit Karma Account and gets their credit score. To start, log in or create an account in the Mode Earn App and then click here to view the offer in the app. (Sorry, iPhone owners, this offer is Android only!)

Not on Android? You can still get the free credit score by clicking here.